April 6, 2018 at 1:53 p.m.

ADDRESSING LEGISLATURE

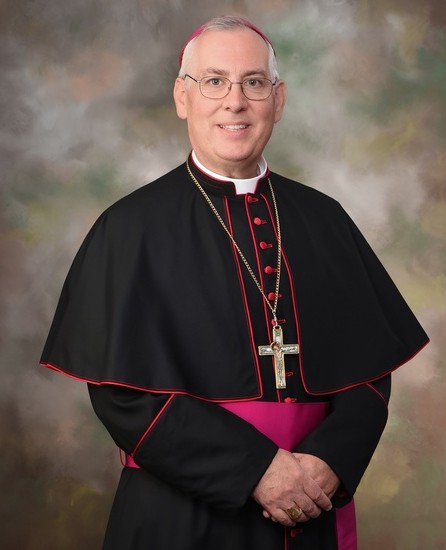

Buffalo bishop's testimony on education budget

I speak on behalf of Cardinal Timothy Dolan, our brother bishops and the more than quarter million students, parents, teachers and administrators who comprise the Catholic school community across the state.

EDUCATION TAX CREDIT

Catholic schools have been instrumental in moving hundreds of thousands out of poverty. If our schools are to continue being a part of addressing New York's inequality of resources and opportunities, we must work together to meet the fiscal challenges that threaten their very existence.

Faith-based schools are disappearing at an alarming rate. The Archdiocese of New York alone was forced to close approximately 60 schools in the last four years. In Buffalo, we have just announced the closure of another 10 schools.

The impact is far-reaching. Families need to find another school- hopefully, another Catholic school. Staff lose their jobs and taxpayers pay a bundle more, unnecessarily, to educate children in public schools.

While the demand for Catholic schools remains strong, working- and middle-class families are finding it increasingly difficult to pay even the modest tuition that we must charge. This restricts our ability to serve poor families. Catholic schools serve many non-Catholic families. If more low-income and minority families had access to scholarships, we'd be filling seats in our under-used schools.

Public schools also face considerable financial challenges. Numerous school districts years ago launched fundraising arms to encourage charitable donations. But the current tax deduction for such donations is insufficient as an incentive. The Education Investment Tax Credit legislation not only would make additional funds available for scholarships to low- and middle-income families, it would provide an equal benefit to public schools and their teachers. Similar legislation has been enacted in other states with great success.

The measure provides a dollar-for-dollar state tax credit for any person or business that makes a donation to public schools or private scholarship organizations. It also provides a tax credit for individuals and businesses contributing to local education funds to support public schools, and donations to pre-kindergarten programs and non-profit organizations providing educational programs in public schools.

In addition to the sizable increase in funding to public schools that is expected in the final state budget, we have no doubt that the final budget will also include significant tax relief measures. Including the Education Investment Tax Credit will ensure that public schools get an additional and ongoing source of revenue. Teachers who spend their own money for classroom supplies will benefit from a personal tax credit for those expenses.

SMART SCHOOLS INITIATIVE

All students are included in the state's computer hardware aid and learning technology grant programs, as well as the federal Enhancing Education through Technology program (Title IId). However, the federal Title IId program is no longer funded, and the state's aid programs are insufficient to address the demands of the Common Core learning and assessment standards.

The Governor's $2 billion Smart Schools bond initiative, which requires legislative and then voter approval, provides a crucial investment in the technology needs of schools, but it is critical that it apply to all children in all schools.

Families who enroll their children in religious and independent schools will be required to pay a share of the debt incurred in supporting this bond initiative. If we are to encourage families to vote for this bond issue, it would be important to ensure it applies equally to all children.

SERVICES AND ATTENDANCE

Let me reiterate our gratitude for the agreement you reached to begin to resolve the Mandated Services Reimbursement/Comprehensive Attendance Policy (MSR/CAP) debt owed to our schools. The enacted budget required restoration of the original CAP reimbursement formula.

The [Education] Department's 2011 analysis allows us to reasonably project the state's unmet obligations to be approximately $195 million for CAP and $30 million for MSR - a total of approximately $225 million in delinquent reimbursement.

The Governor's 2014-15 executive budget proposes a total in MSR and CAP appropriations of $142,793,000. The Governor's recommended appropriation for CAP, however, is approximately $15 million short of what the restored CAP formula would generate this year.

While providing a modest increase in funding, the proposal still allows the state's debt to religious and independent schools to grow by approximately $15 million. The shortfall must be made up by tuition-paying families, which is unfair and unacceptable.

We urge you to increase the CAP appropriation to $59 million to keep the debt from growing further and ensure that current year claims can be reimbursed; and appropriate additional funds to begin satisfying the state's unmet obligation of $225 million for prior-year expenses.

HEALTH AND SAFETY

We are grateful to you and Governor Cuomo for providing $4.5 million in safety equipment funds in last year's budget to assist our schools with needed safety and security measures. We urge you to adopt his recommended appropriation.

NURSING SERVICES

School administrators and teachers are not health professionals and should not be forced to manage students' asthma, diabetes, food allergies and other health conditions. The shortage of school nurses is due, in large measure, to inadequate pay. We urge the Governor and Legislature to ensure that a full-time nurse is available for every public, independent and religious school that needs one.

CAPITAL IMPROVEMENTS

Advances in technology and construction enable our schools to be healthier, safer, more accessible and more energy-efficient. Public schools are able to finance these projects with their local tax levy authority, coupled with state building aid. We urge you to appropriate seed money that would enable religious and independent schools to initiate these worthy projects.

ACADEMIC INTERVENTION

Currently, only $922,000 is appropriated annually to independent and religious schools to implement the Academic Intervention Services (AIS) regulations promulgated by the Board of Regents - far below the $20 million needed. At-risk children may fall behind more, requiring more expensive academic interventions later. AIS funding should be increased so that, like public schools, our schools are able to provide services to children who are most in need.

TRANSPORTATION

We strongly urge the following: Restore 90-percent state reimbursement of school district costs of transporting religious and independent school students; increase the maximum distance school districts are required to transport children to school from 15 to 25 miles; allow parents the option to pay for the cost of transportation beyond 25 miles; ensure that transportation is provided for schools with disparate schedules and calendars; and require small city school districts to transport children up to the maximum mileage limit.

TEACHER TRAINING

The Regents have mandated 87.5 hours of continuing education every five years for certified teachers employed by independent and religious schools. In addition, the regulations of the Board of Regents require new teachers to obtain a mentoring experience in their first year. We urge you to include $10 million in mandated services aid to reimburse independent and religious schools for their expenses in providing the mandated continuing education to certified teachers and $5 million in funding to reimburse schools for mentoring new teachers.

LEARNING TECHNOLOGY

The Governor proposes $3.3 million for learning technology grants. The limited funding for this valuable program, however, serves only 50 school districts, along with their independent and religious school partners. We strongly urge you to increase the appropriation to a level sufficient to enable all needy schools to benefit from this program.[[In-content Ad]]

SOCIAL MEDIA

OSV NEWS

- US presidency of G20 an opportunity to advance human rights, advocates say

- San Antonio archbishop: Profit, politics play roles in inhumane migrant treatment

- With Noem out, Catholic immigration advocates call for change in administration immigration policy

- Lebanon’s Eastern Catholic patriarchs, bishops call for ‘spiral of violence’ to end

- Pope Leo XIV prays for leaders to ‘abandon projects of death’ in peace prayer video

- Sudanese bishops express distress at the massacre of 178 people in northern South Sudan

- Pope Leo XIV meets with authors of book on Latin Mass in US

- Iran’s exiled Christians watch events unfolding across Middle East with hope and fear

- Beloved Notre Dame coaching legend Lou Holtz remembered for ‘building men, not just players’

- Archdiocese’s new guidelines help Kentucky parishes, families prepare for and celebrate sacraments

Comments:

You must login to comment.