April 6, 2018 at 1:53 p.m.

STATE LEGISLATURE

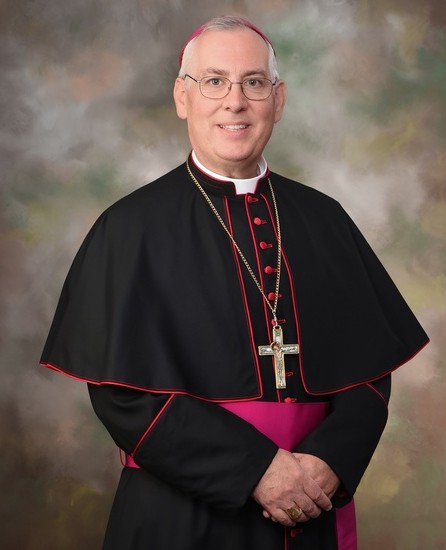

Bishop's testimony on education

For more than 200 years, the state's Catholic schools have been providing an outstanding education to thousands of our state's children, many of whom are not Catholic. Especially in our inner-cities, Catholic schools continue to help bring children out of poverty.

However, parents are increasingly unable to shoulder the dual burden of taxes to support public school while paying tuition to support the education of their own children.

Just since 2010, more than 75 Catholic schools across the state were forced to shut down...resulting in a significant number of children enrolling in the costly and already over-burdened public school system. The shift of enrollment over the last 15 years has increased the cost to taxpayers by nearly $3 billion annually.

EDUCATION TAX CREDIT

Catholic schools have been instrumental in moving hundreds of thousands out of poverty, many from immigrant populations and communities of color.

Demand for Catholic schools remains strong, but working- and middle-class families throughout the state are finding it increasingly difficult to pay even the modest tuition that we must charge.

Our public schools also continue to face considerable financial challenges - but these challenges are not new. In fact, numerous school districts a number of years ago launched their own fundraising arms to encourage charitable donations. But as we can attest, the current tax deduction for such donations is simply insufficient.

The Education Tax Credit legislation helps address needs for both public schools and tuition-paying families. Similar legislation has been enacted in other states with great success.

The measure provides a tax credit for individuals or businesses making a donation to private scholarship organizations or public schools, local education funds established to support public schools, and to non-profit organizations providing educational programs in public schools.

MANDATED SERVICES

The Governor's recommended appropriations under the Mandated Services Reimbursement program (including Comprehensive Attendance Policy, or CAP) are positive developments in resolving the state's delinquency in reimbursement.

While we appreciate last year's $16 million appropriation as an initial payment on prior-year CAP debt, as well as the Governor's recommended $16,768,000 as a second payment on that debt, the State Education Department (SED) continues to use a contrived formula for reimbursing our schools for their CAP expenses.

We estimate that...the state's prior-year CAP obligation is approximately $145 million and that current annual CAP expenses are approximately $61 million.

Our schools have been forced to raise tuition to fill the gap. Tragically, many schools had to close because our families could not bear the increased burden.

HEALTH AND SAFETY

We are grateful to you and Gov. [Andrew] Cuomo for providing $4.5 million in safety equipment funds each of the last two years and are grateful for the Governor's continued funding of this initiative in his executive budget. These funds are critically important in assisting our schools with needed safety and security measures.

We urge you to adopt the Governor's recommended appropriation.

SMART SCHOOLS BOND

The religious and independent school community believes that the Smart Schools Bond Act, enacted last year and approved by voters Nov. 4, lacks sufficient provisions to ensure that our students will benefit from an equitable share of technology funding.

Public schools would be able to use the funds for four purposes: pre-kindergarten classrooms, additional classrooms for overcrowded schools, school security measures and technology upgrades. Religious and independent schools, on the other hand, would benefit from just technology upgrades if, and only if, their respective public school district chooses to spend bond funds on technology.

We ask that you work with the Governor and State Education Department to determine the maximum allowable per-pupil allocation...and require districts to set aside the religious and independent school portion for technology upgrades.

NURSING SERVICES

The shortage of school nurses leaves school administrators and teachers in the untenable position of having to respond to health emergencies and manage chronic health problems.

The shortage is due, in large measure, to inadequate pay. We urge the Governor and Legislature to ensure that a full-time nurse is available for every public, independent and religious school that needs one.

IMPROVEMENTS

Advances in technology and construction techniques enable our schools to be healthier, safer, more accessible and more energy-efficient. Public schools are able to finance these projects with their local tax levy authority, coupled with state building aid.

Religious and independent students, teachers and administrators are no less deserving of the highest-quality facilities. We urge you to appropriate seed money.

ACADEMIC INTERVENTION

Currently, only $922,000 is appropriated annually to independent and religious schools to implement the Academic Intervention Services (AIS) regulations promulgated by the Board of Regents - far below the $20 million that is needed. Without adequate funding now, these at-risk children may easily fall behind even more - thus requiring more expensive academic interventions later.

TRANSPORTATION

When parents are denied their choice of a religious or an independent school because transportation services are not available, are unreasonable or are unreliable, the burden on taxpayers increases as more of these children are enrolled in public schools.

We strongly urge the following: Restore 90-percent state reimbursement of school district costs of transporting religious and independent school students; increase the maximum distance school districts are required to transport children to school from 15 to 25 miles; allow parents the option to pay for the cost of transportation beyond 25 miles; ensure that transportation is provided for schools with disparate schedules and calendars; and require small city school districts to transport children up to the maximum mileage limit, rather than city limits.

TEACHER TRAINING

We urge you to include $10 million in Mandated Services Aid to reimburse independent and religious schools for their expenses in providing the mandated continuing education to certified teachers, and $5 million in funding to reimburse schools for their expenses in mentoring new teachers.

TECHNOLOGY

The Governor proposes $3.3 million for Learning Technology grants. The limited funding for this valuable program, however, serves only 50 school districts, along with their independent and religious school partners. We strongly urge you to increase the appropriation.[[In-content Ad]]

SOCIAL MEDIA

OSV NEWS

- Seeking the living water during Lent

- US presidency of G20 an opportunity to advance human rights, advocates say

- San Antonio archbishop: Profit, politics play roles in inhumane migrant treatment

- With Noem out, Catholic immigration advocates call for change in administration immigration policy

- Lebanon’s Eastern Catholic patriarchs, bishops call for ‘spiral of violence’ to end

- Pope Leo XIV prays for leaders to ‘abandon projects of death’ in peace prayer video

- Sudanese bishops express distress at the massacre of 178 people in northern South Sudan

- Pope Leo XIV meets with authors of book on Latin Mass in US

- Iran’s exiled Christians watch events unfolding across Middle East with hope and fear

- Beloved Notre Dame coaching legend Lou Holtz remembered for ‘building men, not just players’

Comments:

You must login to comment.